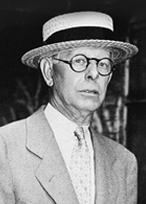

Jesse Livermore

“Patterns repeat, because human nature hasn’t changed for thousand of years”

“It is not good to be too curious about all the reasons behind price movements”

“Go long when stocks reach a new high. Sell short when they reach a new low”

“Markets are never wrong – opinions often are”

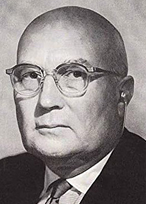

Bernard Baruch

“The impression has built up that the stock market is the cause of booms and busts. Actually, it is the thermometer -- not the fever.”

“No one, not even the most experienced trader, economist or businessman can predict with certainty the course of the stock market”

“It is far more difficult... to know when to sell a stock than when to buy”

“Now is always the hardest time to invest”

Warren Buffett

“Price is what you pay. Value is what you get.”

“Rule No. 1: Never lose money. Rule No. 2: Never forget rule No.1”

“Risk comes from not knowing what you are doing.”

“It’s far better to buy a wonderful company at a fair price, than a fair company at a wonderful price.”

“The stock market is a device for transferring money from the impatient to the patient.”

Gerald Loeb

“Stocks are bought on expectations, not facts”

“Knowledge born from actual experience is the answer to why one profits; lack of it is the reason one loses”

“Successful investment is a battle for financial survival”

Edwin Lefevre

“It never was my thinking that made the big money for me. It was always my sitting. Got that? My sitting tight!”

“The game taught me the game”

“The principles of successful stock speculation are based on the supposition that people will continue in the future to make the mistakes that they have made in the past”

Benjamin Graham

“Buy not on optimism, but on arithmetic.”

“The individual investor should act consistently as an investor and not as a speculator.”

“If you are shopping for common stocks, choose them the way you would buy groceries, not the way you would buy perfume.”

Peter Lynch

“Behind every stock is a company. Find out what it’s doing.”

“Although it’s easy to forget sometimes, a share is not a lottery ticket… it’s part ownership of a business.”

“If you’re prepared to invest in a company, then you ought to be able to explain why in simple language that a fifth grader could understand, and quickly enough so the fifth grader won’t get bored.”