Insurance other than 'Life Insurance' falls under the category of General Insurance. General Insurance comprises of insurance of property against fire, burglary etc, personal insurance such as Accident and Health Insurance, and liability insurance which covers legal liabilities. There are also other covers such as Errors and Omissions insurance for professionals, credit insurance etc.

Term insurance contact details

Call on : - 6377509995

Take your first step to experience best service from team Invest aaj for kal

Why do I need a Term Insurance Plan?

Protection Plan help you shield your family from uncertainties in life due to financial losses in terms of loss of income that may dawn upon them in case of your untimely demise or critical illness. Securing the future of one's family is one of the most important goals of life.

Protection Plans go a long way in ensuring your family's financial independence in the event of your unfortunate demise or critical illness. They are all the more important if you are the chief wage earner in your family. No matter how much you have saved or invested over the years, sudden eventualities, such as death or critical illness, always tend to affect your family financially apart from the huge emotional loss.

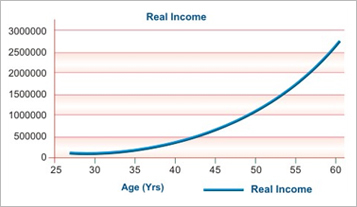

For instance, consider the example of Amit who is a healthy 25 year old guy with an income of Rs. 1,00,000/- per annum. Let's assume his income increases at a rate of 10% per annum, while the inflation rate is around 4%; this is how his income chart will look like, until he retires at the age of 60 years. At 50 years of age, Amit's real income would have been around Rs. 10,00,000/- per annum. However, in case of Amit's unfortunate demise at an early age of 42 years, the loss of income to his family would be nearly Rs. 5,00,000/- per annum.

Term insurance contact details

Call on : - 6377509995

Take your first step to experience best service from team Invest aaj for kal

HDFC Life Click 2 Protect Plus

HDFC Life Click 2 Protect Plus is a term insurance plan in India which provides you comprehensive protection at an affordable price and helps you to protect yourself and your loved ones against the uncertainties that life may throw at you. This term life insurance policy provides wide range of cover options and you can choose the cover depending on your need. You can even secure your family's day to day requirements when you are not around by way of monthly income under Income & Income Plus Option.

- HDFC Life Click 2 Protect Plus provides Comprehensive Protection to you & your family with choice of Plan Options

- The Plan provides you with four cover options:

- Life Option – Lump sum payout of Death Benefit

- Extra Life Option (Accidental Death Benefit) – Lump sum payout of Death benefit in addition extra Sum Assured is paid in case of death due to accident.

- Income Option – Part of Sum Assured payable on death and the remaining payable as monthly income for 15 years

- Income Plus Option – Sum Assured paid on death & monthly income paid for next 10 years. The monthly Income can be chosen as Level or Increasing at 10% p.a.

- Under Life Stage Protection Feature you have an option to Increase your Insurance Cover on certain key milestones of your Life like Marriage, Child Birth without fresh medical test

- Flexibility to choose your policy term of 10 to 40 years as per the cover required

- Option of Regular , Limited & single Premium Payment Term

- Rewards you for healthy lifestyle with lower premium rates for non-tobacco users

- Option to pay premiums annually, half-yearly, quarterly or monthly for Regular & limited premium paying term policy

- You can customize your coverage by opting HDFC Life Income Benefit on Accidental Disability Rider that offers monthly Income of 1% of rider Sum Assured in the event of Total Permanent Disability due to accident for a fixed period of 10 years.

- Death Benefit under the plan is:

- Single Premium Policy: Higher of :

- 125% of Single Premium

- Sum Assured

- Regular Premium Policy: Higher of :

- 10 times the annualized premium

- 105% of all the premiums paid as on date of death

- Sum Assured

- Life Option: The death benefit specified above is paid as lump sum on death.

- Extra Life Option(Accidental Death Benefit): In addition to the death benefit mentioned above an additional benefit equal to Sum Assured is payable in case of death due to accident

- Income Option:

- 10% of the Death Benefit paid as a lump sum upon death

- remaining 90% of the Death Benefit shall be paid as monthly income over next 15 years (0.5% of Death Benefit every month for 15 years)

- Income Plus Option:

- 100% of the Death Benefit specified above shall be paid as a lump sum upon death

- In addition, a monthly income equal to 0.5% of the Sum Assured shall be payable for a period of 10 years.

- The monthly income can be level or increasing at 10% p.a. as chosen by the policyholder

- Save Tax under sections 80C and 10(10D) of the Income Tax Act 1961 as per prevailing tax laws.

- Choose Sum Assured, Policy Term, Plan Option to suit your needs

| Minimum – Maximum entry Age | 18 – 65 years |

| Minimum – Maximum Maturity Age | 28 – 75 years |

| Minimum – Maximum Policy Term | 10 – 40 years |

| Premium Paying Term | Regular, Limited or Single |

| Premium Paying Frequencies | Annual, Half- yearly, quarterly or monthly |

| Minimum – Maximum Sum Assured | Rs 25 Lakhs – No limit subject to satisfactory underwriting |

Age has to be taken as of "last birthday" basis

For more details on risk factors, terms and conditions, please read the Product Brochure carefully and/or consult us before taking a decision.

Tata AIA Life Insurance Sampoorna Raksha Supreme

A Non-Linked Non-Participating Individual Life Insurance Plan We all want to ensure that our loved ones have a comfortable life and secured future. We all thrive to provide happiness and security to our family. We want to make sure they are never short in terms of ¬nancial resources to live the life of their dreams, thereby providing a strong 'foundation' of ¬nancial security for them. Presenting Tata AIA Life Insurance Sampoorna Raksha Supreme Plan, an insurance plan that provides ¬nancial protection to your family and offers you the exibility to choose the plan that suits your need.

- Flexibility to choose payout as a Lump sum or Income (up to 120 months) or both

- Option to Increase cover at Important milestones with Life stage option

- Option to avail medical second opinion/ personal medical case management

- Lower premium rate for Female lives

- Option for Top up

- Inbuilt payor accelerator benefit

- Death benefit along with Regular Income

- Enjoy Life cover upto 100 years of age

- You can choose one or more benefit options (risk covers), including death, accidental death / disability, critical illness and terminal illness

- Flexibility to receive benefit as combination of lump-sum and income for fixed period, income till survival of partner, or as waiver of future premiumsor either as lump-sum, or monthly income for up to 10 years

- You can extend protection to your loved ones under the same plan

- Option to receive the return of balance premiums on maturity

- You can choose one or more benefit options (risk covers), from a list of 5 available options, including disability, hospitalization, and illness

- Flexibility to receive benefit as combination of lump-sum and income for fixed period, or either as lump-sum, or monthly income for up to 10 years

- You can cover yourself, along with your family against the risks covered either while taking the policy, or at the time of any policy anniversary

- Income tax benefits as per the prevailing tax laws

| Minimum age at issue | For POS:

Life, Life Plus, Credit Protect: 18 Years Other than POS: Life, Life Plus, Credit Protect: 18 Years Life Income: 30 Years |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| Maximum age at issue |

For POS: Life, Credit Protect: 60 Years Life Plus: 55 Years Other than POS: Life, Life Plus, Credit Protect: 65 Years Life Income: 50 Years |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| Premium payment term | For PoS:

For Other than PoS:

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| Minimum – Maximum Policy Term | Premium payment frequency options |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| Age at maturity |

For PoS: 65 For other than PoS

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sum assured |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

For more details on risk factors, terms and conditions, please read the Product Brochure carefully and/or consult us before taking a decision.

Term Insurance

Term Insurance